For a teacher earning Ksh50,000 per month, the dream of securing a mega loan of Ksh1.2 million is tantalizing. It promises a chance to renovate a home, invest in a business, or meet other personal goals. Yet, as many teachers have learned, borrowing is only as powerful as the discipline that follows repayment. Without careful planning, a loan that should be a stepping stone can easily become a burden.

Consider the typical scenario: a Ksh1.2 million loan at a bank interest of 14% per year, spread over six years. The monthly repayment comes to roughly Ksh25,365 — just about half of a teacher’s monthly salary. This amount is manageable but significant. It highlights a crucial reality: when you take a large loan, nearly half of your income is immediately committed to repayment. Discretionary spending must therefore be restrained, and every shilling should be directed wisely.

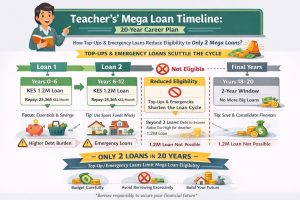

Now, imagine a teacher with 20 years of service remaining. Within this span, the structured repayment plan of such loans would ideally allow three full cycles of a Ksh1.2 million loan. Each loan cycle lasts six years, leaving a two-year window at the end of their career where taking another loan would either require a higher repayment than their salary allows or a significantly reduced loan amount.

However, the reality is often more complicated. Top-up loans, emergency loans, or short-term advances can scuttle the repayment cycle. Even small amounts added to an existing debt increase the monthly repayment burden. Over time, these additional loans can push the teacher’s debt-to-income ratio beyond safe limits.

ALSO READ:

Murang’a ECDE teachers protest exploitative employment terms, demand PnP

As a result, the teacher may realistically qualify for only two full mega loans instead of three over their 20-year career. This shows that borrowing frequently without careful planning reduces future eligibility and financial flexibility.

The Loan Cycle Timeline with Top-Ups and Emergency Loans

Here’s a visual representation showing how top-ups and emergencies can affect loan cycles:

Key Takeaways from the Timeline:

Loan 1 (Years 0–6)

Monthly repayment: Ksh25,365

Focus: Essentials & Savings

Tip: Avoid taking unnecessary top-ups; preserve capacity for future loans

Loan 2 (Years 6–12)

Monthly repayment: Ksh25,365

Focus: Invest Wisely — home improvements, income-generating projects

Tip: Emergency loans may increase monthly obligations and reduce future loan eligibility

Loan 3 (Years 12–18)

May not be feasible if top-ups or emergencies have increased debt

Focus: Consolidate finances and avoid unnecessary borrowing

Tip: Prioritize debt repayment over new loans to maintain financial health

Final 2-Year Window (Years 18–20)

No full loan possible

Focus: Save and consolidate finances

Tip: Use this period to strengthen financial reserves and prepare for post-retirement life.

ALSO READ:

Teachers’ union elections foreshadow the stakes of 2027 general polls

The cycle emphasizes why teachers must spend wisely. Wise financial behavior during each loan cycle can yield multiple benefits. For instance, a teacher who borrows responsibly for a home renovation ensures that their living conditions improve without jeopardizing their monthly cash flow. Another who invests part of the borrowed funds in income-generating opportunities can potentially repay the loan faster, freeing them for the next loan cycle or enabling savings for retirement. The key is discipline and planning: each shilling spent must be assessed for both its immediate necessity and long-term value.

In essence, borrowing a mega loan is not just about how much you can take — it’s about how well you can manage it. Teachers must recognize that every additional loan — even small top-ups or emergency advances — affects their future borrowing potential. A teacher who carefully respects the loan cycle and limits extra loans can fully utilize two mega loans and maintain financial stability throughout their career. Loans can be stepping stones, but reckless spending turns them into traps.

A teacher’s ability to borrow is limited by both salary and time, but their ability to spend wisely is limitless. Every loan cycle is an opportunity to strengthen financial habits, improve living conditions, and even create wealth. By understanding the loan cycle, avoiding unnecessary top-ups, and aligning borrowing with careful spending, teachers can turn the temptation of mega loans into a pathway for financial stability and long-term prosperity.

By Hillary Muhalya

You can also follow our social media pages on Twitter: Education News KE and Facebook: Education News Newspaper for timely updates.

>>> Click here to stay up-to-date with trending regional stories

>>> Click here to read more informed opinions on the country’s education landscape