Teaching is one of the noblest professions, and every day a teacher walks into a classroom carrying the dreams of children, the trust of parents, and the expectations of society. Yet behind the chalkboard and the smile, many teachers carry a burden that weighs heavier than any pile of books — the burden of an overcommitted pay slip.

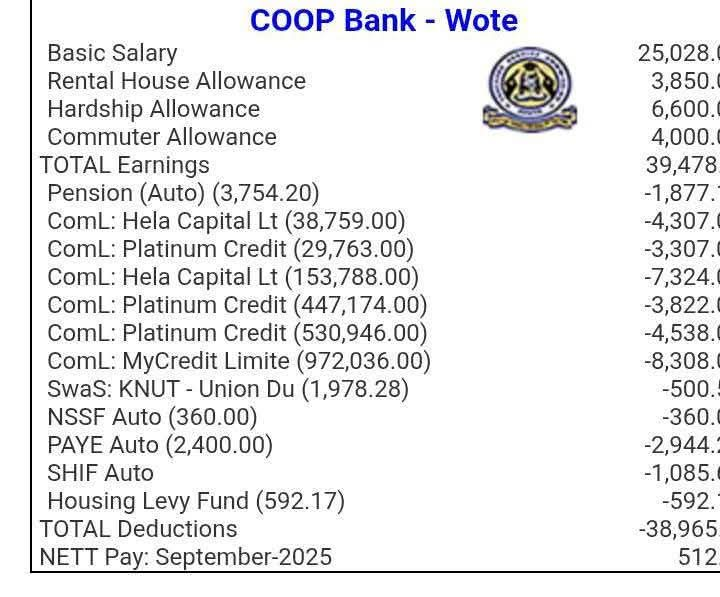

A pay slip should be a source of dignity, stability, and provision. It is meant to put food on the table, educate children, and secure a teacher’s future. Sadly, for many, it has become a chain rather than a lifeline. With deductions swallowing nearly the entire salary, the teacher is left helpless, unable to breathe financially, and constantly trapped in a cycle of stress. What should bring peace of mind instead brings endless worry.

The trap rarely begins with one giant mistake. It often starts with small decisions that appear harmless — a loan to cover school fees, a salary advance for medical bills, or a purchase that could have been postponed. At first, such commitments seem manageable. But little losses at the preliminary stages eventually amount to heavy losses. A small deduction today opens the door to larger ones tomorrow. Before long, the payslip is consumed by debts owed to banks, SACCOs, mobile lenders, and even shylocks. By the time money is deposited into the account, it has already been spent.

And debt is never silent. It follows the teacher into the classroom. A teacher whose payslip is overcommitted cannot teach effectively. They may stand before learners, but their mind is elsewhere — replaying conversations with creditors, worrying about bills, or dreading the knock of auctioneers. The classroom suffers because passion is drowned by worry. A weary teacher cannot inspire, and a restless mind cannot concentrate. Learners pay silently for this invisible burden.

ALSO READ:

KNUT official warns teachers against “sweet” loan traps, urges financial caution

The same struggle stretches into the home. Families experience smaller meals, unpaid school fees, and constant quarrels between spouses. A teacher who should stand as a pillar of stability instead becomes a source of frustration. In society, dignity fades as colleagues whisper; relatives withdraw, and neighbors gossip. Some teachers, desperate to keep up, fall into unethical practices such as misusing school funds or falsifying records, only to sink deeper into trouble. Financial stress corrodes not only stability but also integrity.

The weight is not only financial; it is deeply emotional. Many teachers live under silent depression, suffering sleepless nights, stress-related illnesses, and a creeping sense of hopelessness. Tragically, some have taken their own lives, unable to bear the despair of unending debt. These are men and women who once gave everything to shape young minds, yet could not escape the invisible chains around their own lives. Debt robs not only money but also hope — and when hope dies, even life itself can feel unbearable.

Yet, this is not the only story. There are teachers who have chosen a wiser path. Take the case of Mr. Olaka, who borrowed endlessly until his payslip lost all meaning. He became restless, lost joy in teaching, and arrived at retirement unprepared, dependent on others and filled with regret. Contrast him with Mr. Saleh, who lived modestly, avoided unnecessary loans, and disciplined himself to save consistently. Through his SACCO and small ventures, he built a cushion of stability. Retirement for him was not a curse but a blessing. Both were teachers, but their decisions led to entirely different endings.

ALSO READ:

Hosea 4:6 – Why people still perish for lack of knowledge in the age of information

Every teacher today stands at the same crossroad. One road promises comfort through easy loans but leads to anxiety, bondage, and despair. The other demands sacrifice, discipline, and patience but leads to stability, independence, and dignity. A payslip is not just a record of earnings; it is a reflection of choices. It can either enslave or set one free.

The time to make that choice is not at retirement; it is now. Guard your payslip from unnecessary deductions. Live within your means. Save consistently and invest wisely, even in the smallest ventures. Do not underestimate the power of small beginnings — for little losses grow into ruin, but little savings grow into wealth. Increase the small savings however little they appear, because one day they will matter greatly. What seems like a drop today becomes a reservoir tomorrow. What feels insignificant now may one day build a home, educate a child, or sustain you in retirement.

Practical financial discipline is the way forward. Start with a budget — know what you earn, list what you spend, and cut out what is unnecessary. Prioritize needs over wants. Join a SACCO, not only for loans but for the power of saving and earning dividends. Start a simple side hustle that does not distract from teaching — farming, poultry keeping, a small shop, or tutoring services. Diversify your income so that your survival does not depend on a single payslip. Above all, save before you spend, no matter how little. Drops of water will one day become a mighty river.

A free payslip makes for a free mind. A free mind makes for a focused teacher. And a focused teacher inspires generations. Discipline over desperation, wisdom over regret, and dignity over despair — these are the choices that matter.

Guard your payslip, guard your dignity, and guard your future.

By Hillary Muhalya

You can also follow our social media pages on Twitter: Education News KE and Facebook: Education News Newspaper for timely updates.

>>> Click here to stay up-to-date with trending regional stories

>>> Click here to read more informed opinions on the country’s education landscape