It’s no longer business as usual for poor and voiceless of thousands of retired government employees , including teachers who are currently languishing and suffering in abject poverty over failure to access their outstanding pension benefits .

This comes despite President William Ruto decree over the full tax exemption of pension and gratuity payment under renewed tax laws {Amendment} Act , 2024, to exempt pension benefits from registered schemes from income tax with a view to cushion retirees against the rising cost of living goes unheeded a year later.

Senior citizens dreams to enjoy adequate retirement benefits to maintain a decent standard of living was shattered over a year as a hotly stalemate between two key players of the government which should work tirelessly in mitigating their plight and sustain their dignity, societal status maintain high-quality life.

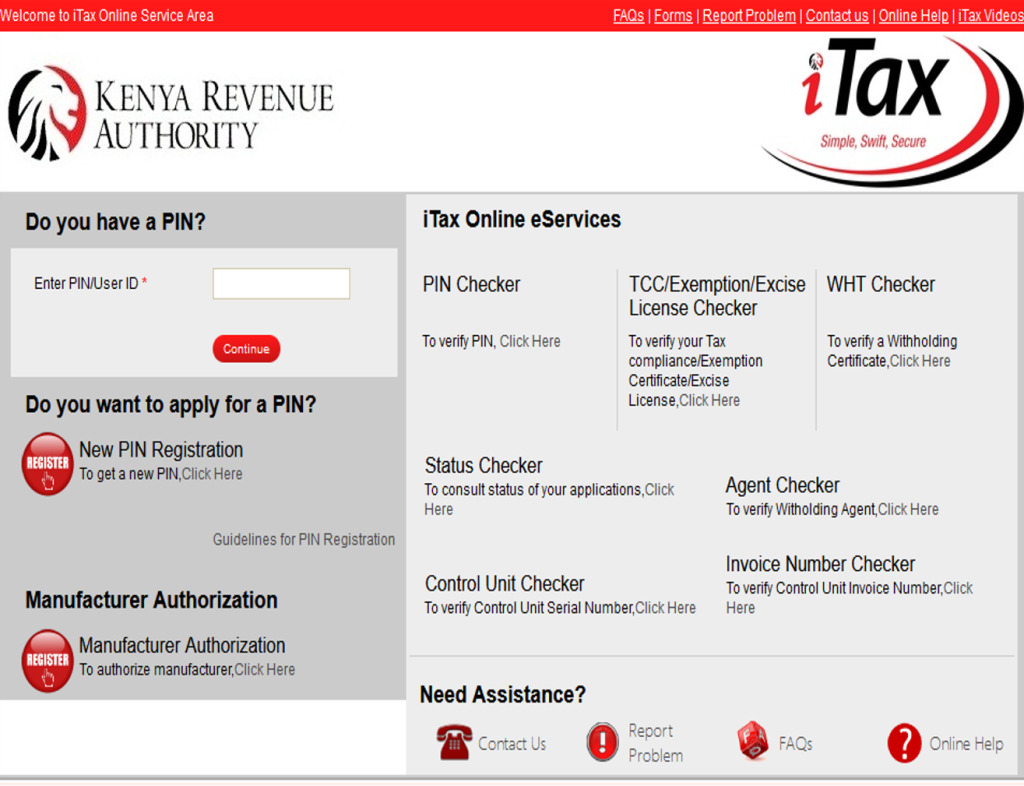

Biting standoff between the treasury and the Kenya revenue authority {KRA} over taxation of payments has left thousands of retires with no option to beg/loan money which a mandatory medium of exchange to meet the basic needs like food, clothing, shelter ,education and healthcare or means of travelling to and makes life unusual business.

This following the enactment of historic controversial of 2024 Financial Bill cum Tax Laws (Amendment) Act 2024 as the Treasury Pension and the Kenya revenue authority {KRA} are reading from two different scripts over ideal implementation strategy of the taxation payments as retirees entangled with futuristic uncertainties.

The treasury strictly holds that all the benefits that had not been processed at the time of exemption, included. However , the KRA is a different school of thought that this should merely apply to the pensions to be paid after the exemption amid not only raising more questions than answers over the futuristic benefits ahead eagerly awaited 2025 Christmas and New year festivities in which families celebrate and bond together in style with their beloved ones.

ALSO READ:

Nyamira marks second cohort graduation as 32 students graduate with ICT skills

Kenya’s Tax Laws (Amendment) Act 2024, are meant to see former educators and public civil servants retirees continue paying tax of up to 65 years of age, as unwavering and renewed commitment in addressing e healthcare burdens for senior citizen, and empowering retirees for a secure financial future Recognizing this, the Tax Laws (Amendment) Act 2024 introduces provisions that allow contributions to post-retirement medical funds—up to Ksh 15,000 per month—to be tax-deductible amid the National Retirement Benefits Policy which encourages members to voluntarily save for their health through the post-retirement medical sub-funds permitted with in retirement benefits schemes leave alone public participatory.

The government of the day also owes Kenyans explanation whether retirees who exited the service prior to December 27,2024 are affected, when the bill came into force. If not affected, why are their dues still pending over a year later and for how long should the center hold?.

There is a ray of hope for unlocking retirees benefits following recent assentation by Treasury cabinet secretary John Mbadi to actualize meetings between senior officers and the tax agency ‘s leadership to resolve matter amid scholars and analysts attributes the incumbent situation to a purely administrative gap that calls for an urgent solution.

Historically, the question raised by Embu Senator Alexander Mundigi , why teacher retirees benefits takes years and years to secure their dues remains challenging and hard to answer. The financial question dates back 2023 when the former Education CS Ezekiel Machogu answered easily to the Senate in 2023 and Kenyans that retirees benefits were to be settled at Pensions Department at National Treasury within six months in benchmark with public civil servants which takes three months to maturity.

ALSO READ:

A year later, the 13th National Assembly on August 7, 2024 passed the Pensions (Amendment) Bill, (National Assembly Bill No. 44 of 2022). The Bill amends saw all Government Ministries and departments to submit necessary documents to the Pensions Department within 30 days of an employee’s retirement and the Pensions Department within a 60-day window to process pension payments for retirees. The Bill sponsored by Hon. Didmus Barasa (Kimilili) which met with widespread approval from Members of the National Assembly includes. Barasa Bill will ensure that people who retirein this country get their pensions in a period of not more than 90 days, solving the current backlog and Nyaribari Masaba, Daniel Manduku argued that the Bill shall bring much-needed financial stability to senior citizens. And in 13 Sep 2025 —Head of State and Kenya’s CEO of the Fifth Republic of Kenya, Dr Willian Ruto via X platform issued heartening decree that all teachers retirees to receive their benefits within 10 days up from up from 21 days recommended by per Citizen Delivery Charter for the Pension Department , but yet to be adhered to.

It’s however, disappointing and regrettable to note that to date the promises are yet be actualized amid scholarly deep concerns over delayed retirees’ benefits.

Delayed monies or lack of it Money as means of exchange means that meeting basic needs, medical care travelling amid higher costs of living makes life boring and unsure business . Concluding thoughts by

A scientific study (Ejionueme, 2012) earmarked financial delays as a root cause to health gap due to failure to afford a balanced diet or meet medical expenses, loneliness , low self-esteem, poor eye sight, back pains, hypertension, arthritis, stroke and depression . missing salary and allowances dehumanizes one to the state of despair, shoddy quality life as the majority succumbed to mental related loss identity, confidence, self-esteem depression, loneliness, lower life satisfaction and preventable complicated illnesses to mention but a few.

The sooner the Kenya Kwanza key players in retirees pensions, urgently embrace Tigania West, (Dr.) John Mutunga school of thought that the backlog of pension cases and provision of adequate care for retirees.” during the Pensions (Amendment) Bill, (National Assembly Bill No. 44 of 2022), the Speaker of the National Assembly the better.

By Onwonga Yabesh

History analyst

You can also follow our social media pages on Twitter: Education News KE and Facebook: Education News Newspaper for timely updates.

>>> Click here to stay up-to-date with trending regional stories

>>> Click here to read more informed opinions on the country’s education landscape